The Average True Range (ATR) is a popular volatility indicator used by traders across various markets. Understanding its core principles and applications can significantly enhance trading strategies, particularly in volatile environments. This post will delve into the basics of ATR, explore its appeal to traders, and introduce ATR-TradeShield, an automated tool that leverages ATR for sophisticated trade management.

1. What is ATR?

The Average True Range, developed by J. Welles Wilder Jr., is a technical analysis indicator that measures market volatility. Unlike indicators that focus on price direction, ATR quantifies the degree of price fluctuation over a given period. It calculates the average of the “true ranges” over a specified period (typically 14 periods). The “true range” considers the greatest of the following:

- Current high minus the current low.

- Absolute value of the current high minus the previous close.

- Absolute value of the current low minus the previous close.

By considering these three possibilities, ATR captures volatility even when gaps exist between trading days or during limit moves.

2. Why Traders Choose ATR ?

Traders gravitate towards ATR for several compelling reasons:

- Volatility Assessment: ATR provides a clear and concise measure of market volatility. This allows traders to adapt their position sizes and strategies based on the current market conditions. Higher ATR values indicate greater volatility, prompting traders to potentially reduce position sizes or widen stop-loss orders.

- Stop-Loss Placement: ATR is commonly used to determine appropriate stop-loss levels. By multiplying the ATR value by a certain factor (e.g., 2x ATR, 3x ATR), traders can establish stop-loss orders that are proportionate to the prevailing market volatility. This helps prevent premature stop-outs due to normal market fluctuations.

- Take-Profit Target Setting: Similar to stop-loss placement, ATR can be used to set realistic take-profit targets. By targeting profit levels based on ATR multiples, traders can aim for gains that are commensurate with the market’s volatility and potential.

- Dynamic Position Sizing: ATR can inform position sizing decisions. In highly volatile markets, traders might reduce their position sizes to manage risk effectively. Conversely, in less volatile markets, traders may increase their position sizes.

- Trend Confirmation (Indirectly): While not a trend indicator itself, a rising ATR can sometimes indicate increasing momentum in a trend, while a declining ATR may suggest the trend is weakening.

3. ATR-TradeShield: Automated Trade Management with ATR

ATR-TradeShield is an automated trading tool designed to simplify and enhance trade management by utilizing the power of ATR. It offers a streamlined approach to setting stops and targets based on dynamic ATR calculations, automating processes that would typically require manual intervention.

The tool offers two key automated features:

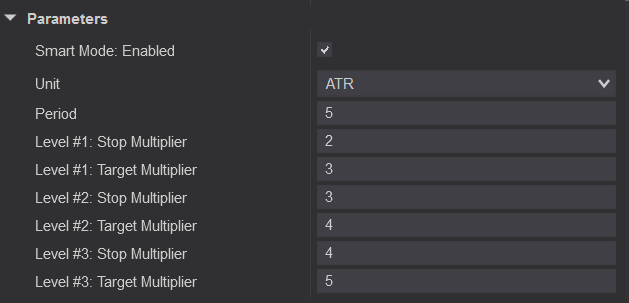

- Auto 3 Levels of Targets & 3 Levels of Stops using ATR: This feature allows traders to automatically define three distinct take-profit target levels and three corresponding stop-loss levels, each calculated as a multiple of the ATR value. This enables a layered approach to profit taking and risk management.

- Auto Trailing Stop using ATR: This feature automatically adjusts the stop-loss order as the price moves in the trader’s favor, locking in profits and protecting against adverse price movements. The trailing stop is dynamically calculated based on the ATR value, adapting to changing market volatility.

Key features of ATR-TradeShield include:

- Dynamic Stop/Target Placement using ATR multiples (e.g., 2xATR, 3xATR): Provides flexibility in setting stop and target levels based on customized ATR multiples.

- Supports up to 3 Stop/Target levels per trade: Allows for granular control over risk and reward.

- Auto-adjusts Stops and Targets as price moves: Eliminates the need for manual updates, saving time and effort.

- Auto merge or split Stop/Target levels with one click: Simplifies the process of adjusting target and stop levels based on market conditions.

- Choose between classic ATR or flexible ninZaATR, Tick: Offers flexibility in selecting the ATR calculation method.

In conclusion, ATR is a valuable tool for traders seeking to understand and adapt to market volatility. ATR-TradeShield leverages the power of ATR to automate key aspects of trade management, potentially improving trading efficiency and profitability by dynamically managing risk and reward. By understanding the fundamentals of ATR and exploring tools like ATR-TradeShield, traders can gain a competitive edge in today’s dynamic markets.

Leave a Reply