Bollinger Bands are one of those classic tools every trader hears about. But most traders?

They’re using them wrong — or barely scratching the surface.

Let’s break down how to really use Bollinger Bands — and then I’ll show you 3 powerful tools that completely changed the way I trade with them.

🔍What Are Bollinger Bands?

In simple terms:

They’re dynamic volatility envelopes that expand and contract around price.

- The middle band = a moving average (usually 20 SMA)

- The upper and lower bands = 2 standard deviations above and below

That means the bands automatically adjust to market conditions. When price gets close to the upper or lower band, it’s telling you something:

- Upper band → Price may be overextended (but not always a reversal!)

- Lower band → Potential exhaustion to the downside

- Squeeze → Consolidation is tightening; breakout may be near

⚙ How I Use Bollinger Bands in Trading?

Here are 3 go-to strategies I like:

1. Bollinger Reversal Pro

When price pierces the upper or lower band with strong momentum — but then immediately rejects and returns inside — that’s a signal of overextension and possible reversal.

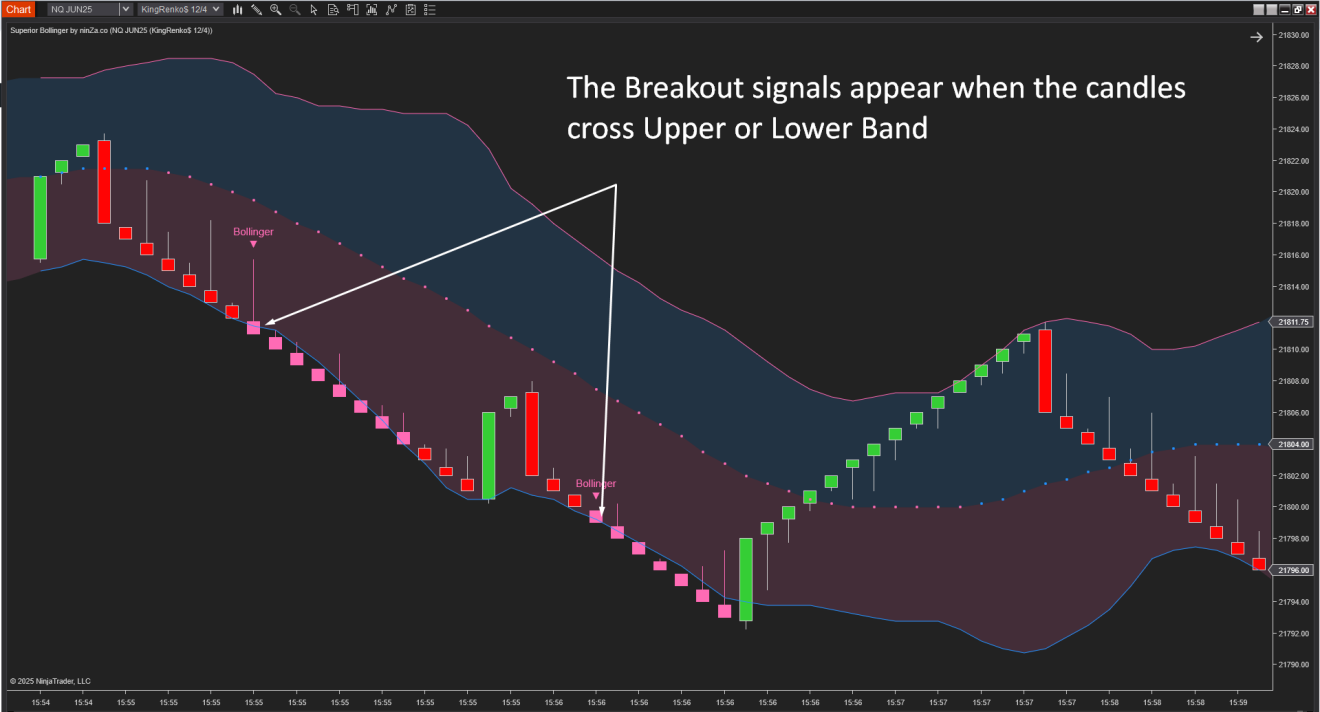

2. Superior Bollinger

When the bands get super tight, volatility is drying up. That’s usually followed by a breakout. I prep for either direction, then trade the breakout + retest.

3. Bollinger %B Pro

%B shows where price is relative to the bands, on a scale of 0 to 1.

- 0 = touching lower band

- 1 = touching upper band

- 0.5 = smack in the middle

Great for detecting trend strength, false breakouts, and momentum fades.

⏱ What Timeframe Works Best?

This is a common question — and super important.

While Bollinger Bands can be applied to any chart, I’ve found them most effective on intraday timeframes like the 5-minute, 15-minute, or 1-hour charts for short-term opportunities.

That said, I highly recommend trading with Renko charts, especially KingRenko$.

Why?

Because KingRenko$ provides accurate OHLC data, unlike many other Renko types. This gives you clean, noise-filtered setups while keeping the integrity of candlestick analysis. Perfect for Bollinger Band strategies — especially breakouts, retests, and squeezes. You get a clear view of momentum shifts and can act fast without second-guessing fake moves.

🎯Final Thoughts

Bollinger Bands are powerful — but only when used intelligently.

If you’re just watching the price hit a band and hoping for a reaction… that’s not a strategy.

But when you combine the right setup logic with the right tools, you unlock the real magic behind them.

Let me know if you want screenshots or live examples of these in action — happy to share!

Trade well,

Grace

Leave a Reply